Constant Regulatory Flux

Rapid mandate changes require strong change management systems and tighter documentation.

Built for banks, insurers, credit unions, and investment firms facing rising regulatory scrutiny, growing operational risk, and mounting audit pressure.

From streamlining third-party risk, legal holds, ESG reporting, and policy attestations to supporting anti-money laundering (AML) and know-your-customer (KYC) compliance efforts with automated, continuous monitoring and evidence collection, Mitratech’s financial services compliance software helps you respond faster and demonstrate compliance with confidence.

Whether preparing for your next regulatory exam, managing global ESG disclosures, or minimizing vendor and workforce risks, Mitratech delivers the visibility, control, and audit-ready proof modern financial institutions demand.

Rapid mandate changes require strong change management systems and tighter documentation.

Higher SAR volumes, stricter onboarding rules, and pressure to reduce false positives are straining compliance teams.

Increased reliance on fintechs, outsourcers, and cloud vendors with fragmented oversight.

GLBA, GDPR, and state-level compliance demands across growing data ecosystems are becoming increasingly hard to manage.

Difficulty proving enterprise-wide alignment on ethics, conduct, and fiduciary policies can lead to inconsistent practices, increased liability, and gaps in audit readiness.

Regulatory inquiries trigger urgent scrambles to locate documentation and prove control adherence.

Conflicting ESG, privacy, AML, and tax rules across jurisdictions strain centralized governance.

Spreadsheets, email chains, and disconnected systems hinder responsiveness and visibility.

Growing demand for transparent, verifiable sustainability, and governance reporting.

Rising volume of legal holds, whistleblower claims, and regulator-driven inquiries that can threaten down time and reputation damage.

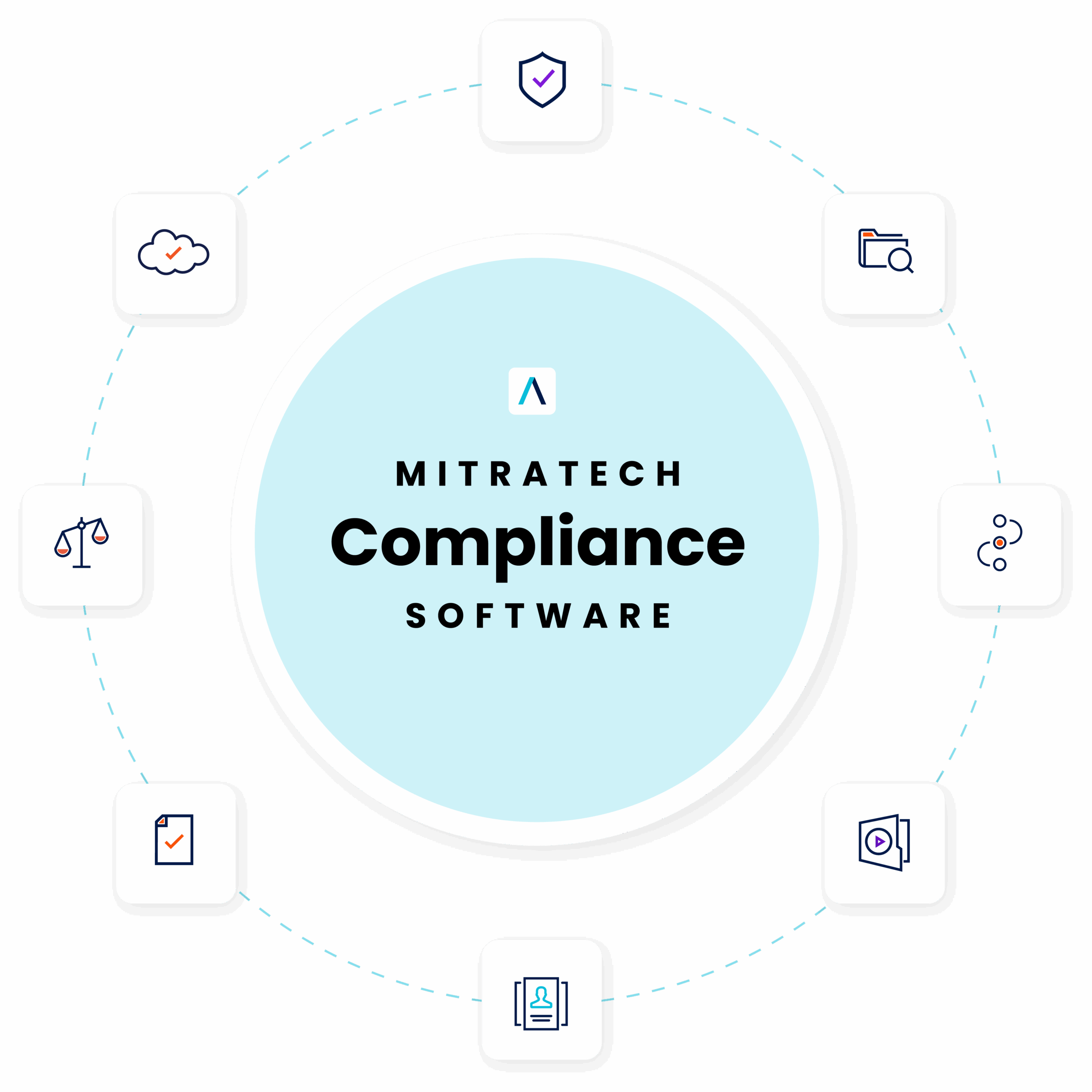

Deliver compliant, resilient, and cost-efficient operations across every financial function — with user-friendly financial services compliance software trusted by the world’s leading financial institutions.

Continuously assess, onboard, and monitor external vendors, cloud providers, outsourcers, legal counsel, and fintech partners — with dynamic profiling, SLAs, and regulatory alignment.

Explore Third-Party Risk SolutionsAddress operational risk at the system level — with frameworks for cybersecurity, EUC risk, model validation, and NIST/ISO alignment across enterprise systems.

Explore IT & Cyber Risk ManagementStay ahead of evolving global and domestic mandates — including SEC, CFPB, FINRA, FATF, ESMA, and more — with built-in regulatory intelligence, tracking dashboards, and compliance control mapping.

Explore Reg. Change Management SoftwareDevelop, test, and deploy automated response plans for outages, data breaches, or systemic market disruptions — in alignment with the expectations of the FFIEC, OCC, FDIC, and the Federal Reserve. Explore Easing Business Continuity Plan Updates for a Financial Institution.

More About Continuity Planning ToolsGenerate, approve, and store client agreements, investment disclosures, and institutional contracts — with automated templates and compliance safeguards.

Entdecken Sie Mitratech Document AutomationTrack legal spend, manage enforcement actions, and monitor outside counsel performance — all from a centralized legal operations hub.

Explore Case Management ToolsPreserve and collect data defensibly in response to subpoenas, regulatory audits, or whistleblower events — with chain-of-custody tracking and automated workflows.

Discover Mitratech's Legal HoldDigitize and standardize tasks like risk control self-assessments, audit responses, and third-party escalations — and streamline AML and KYC evidence reviews and approvals — with no-code automation.

See Workflow Automation in ActionMaintain workforce eligibility across domestic and cross-border hiring scenarios — with audit-ready I-9 and E-Verify compliance tools.

Explore I-9 Compliance SolutionsVerify and manage background checks, licenses, and certifications for regulated or high-risk roles in banking, insurance, and asset management.

Learn More About Background ScreeningAssign and track mandatory training — including AML, fiduciary duty, insider trading, and anti-harassment — across global teams and branches.

See Compliance Training ToolsEnable secure, confidential reporting of fraud, harassment, and compliance breaches — with case tracking and root cause analytics.

Explore Incident Reporting Software

Rabobank

Plains Commerce Bank

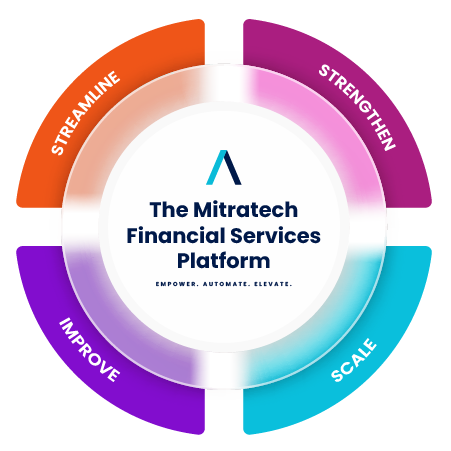

Built to deliver better compliance monitoring and decision-making for financial institutions, trusted by banks, insurers, and asset managers — and ready for your next exam, audit, or disclosure.

Automate onboarding and ongoing due diligence with centralized workflows for third-party and customer risk evidence — including AML, KYC, CIP, and sanctions-monitoring data — to support BSA/OFAC compliance and evolving global requirements.

Purpose-built for regulated financial environments. Easy to deploy, simple to scale, and designed to deliver real-time oversight without additional operational burden.

Mitigate third-party risk by automating vendor onboarding, tracking financial crime certifications, enforcing policy compliance, and surfacing control gaps across contracts, NDAs, and disclosures.

Standardize legal holds, internal investigations, HR issue tracking, and policy attestations — all while maintaining audit trails that meet requirements of the CFPB, SEC, and more.

Financial services compliance software is a suite of digital tools that help banks, insurers, credit unions, and investment firms manage regulatory, legal, and operational risks. It enables institutions to automate traditionally manual processes like policy enforcement, AML monitoring, regulatory change tracking, and third-party risk management.

It centralizes documentation, approvals, and workflows across compliance processes — from regulatory change management to policy attestations — making it easier to respond to OCC, SEC, or internal audit requests with complete, defensible records.

Yes, it can support AML and KYC compliance efforts by centralizing evidence collection, continuously monitoring third-party and vendor risks, and automating related workflows such as escalations, reviews, and approvals. While it is not a transaction monitoring or identity verification tool, it helps financial institutions demonstrate due diligence and streamline processes tied to AML, KYC, and broader BSA/OFAC compliance requirements.

Absolutely. The software includes third-party risk management (TPRM) capabilities that allow financial institutions to assess, monitor, and document vendor compliance — including fintech providers, legal firms, and outsourcing partners.

Regulatory change management tools track new or updated financial regulations from agencies like the SEC, CFPB, and FATF, assess their business impact, and help teams implement changes across controls, policies, and workflows.

Yes. Financial services compliance software often includes legal case management, eBilling, legal hold, and contract automation — allowing Legal, Risk, and Compliance teams to work from a unified platform with shared visibility and controls.

Global banks, regional credit unions, insurance carriers, investment advisors, and digital-first fintech firms all use financial services compliance software to stay agile, audit-ready, and regulator-compliant.

Look for cloud-based solutions that support:

A unified platform ensures these functions are seamlessly connected across the business.

©2025 Mitratech, Inc. Alle Rechte vorbehalten.

©2025 Mitratech, Inc. Alle Rechte vorbehalten.